News and Blog

-

19 July 2019

Congratulations Samia, Hamid, and Naveena on leading three DFS papers which have just been accepted for CSCW!

-

18 May 2018

The DFSRG has four papers accepted to the ACM Compass Conference on the financial services work, great work everybody! The papers describe Rowan’s study of security vulnerabilities in ThinSims, Aditya and Shri’s overview of security and privacty, Samia’s work on Gender and Financial Services in Pakistan, and Sarah’s study of mobile money in Ghana. The papers are:

- A Qualitative Exploration of Mobile Money in Ghana,

Sarah Yu (University of Washington), Samia Ibtasam (University of Washington) - Gender and Financial Inclusion in Pakistan, Samia Ibtasam (University of Washington), Lubna Razaq (Information Technology University), Haider W. Anwar (Northeastern University), Hamid Mehmood (Information Technology University), Kushal Shah (University of Washington), Jennifer Webster (University of Washington), Neha Kumar (Georgia Institute of Technology), Richard Anderson (University of Washington)

- ThinSIM-based Attacks on Mobile Money Systems, Rowan Phipps (University of Washington), Shrirang Mare (University of Washington), Peter Ney (University of Washington), Jennifer Rose Webster (University of Washington), Kurtis Heimerl (University of Washington)

- Examining Security and Privacy Research in Developing Regions, Aditya Vashistha (University of Washington), Richard Anderson (University of Washington), Shrirang Mare (University of Washington)

- A Qualitative Exploration of Mobile Money in Ghana,

-

18 March 2018

The third Digital Financial Services (DFS) Workshop was held on Friday, March 16 featuring invited speakers Patrick Traynor (University of Florida) and Bill Maurer (UC Irvine). Slides and videos of the talks will be posted soon. The agenda is here.

-

05 February 2018

The University of Washington’s Digital Financial Services Research Group (DFSRG) will host its third Digital Financial Services (DFS) Workshop on March 16th, 2018. This event will take place in the Gate’s Commons in the Paul G. Allen Center for Computer Science and Engineering (CSE 691) between 10 am and 5:00 pm, with a reception to follow from 5-6 pm. Details will be posted soon!

-

30 January 2018

Samia Ibtasam gave a talk in this week’s Change seminar: Digital Financial Services: Gender & Learnability.

Abstract: Worldwide, two billion people remain unbanked, the majority of whom reside in resource-constrained environments. While banks have limited reach due to high overhead costs of physical expansion, the global increase in mobile penetration has created opportunities to serve the unbanked using mobile-based Digital Financial Services (DFS). However, there are many factors that affect the understanding, adoption, and use of DFS including learnability of the systems and gender of the users.

In this talk, we discuss ways in which previous exposure or domain knowledge improve learnability, and we recommend that metrics for learnability should include effectiveness and help sought, independent of usability. We also identify DFS adoption opportunities such as user readiness, interface improvements, and women’s independence. We also discuss the role of gendered barriers in the readiness for and adoption of Digital Financial Services (DFS) and the impact of gendered roles in curtailing or enhancing the same. We present our analysis of the affordances or, lack thereof, in affordability of funds, the authority of transactions, access to technological devices, and agency of social and cultural mobility–all of which are prerequisites to fully utilizing DFS.

-

01 December 2017

Overcoming barriers to financial inclusion requires partnerships between academic researchers and industry specialists to determine technological solutions that can be translated and widely adopted. To work toward such partnerships, on the 15th and 16th of November, 2017 the University of Washington’s Digital Financial Services Research Group (DFSRG), under the School of Computer Science and Engineering, and Information Technology University’s FinTech Center hosted the 2017 Digital Financial Services Workshop in Lahore, Pakistan. The workshop was co-located with the 2017 Information Communication and Technology for Development (ICTD) International Conference.

The goal of this workshop was to bring together members of the ICTD academic community with industry specialists of digital financial services to create opportunities for collaboration and knowledge sharing. The workshop bridged between the Pakistan FinTech community and the international ICTD research community through panel discussions, working groups, and position papers. The workshop also functioned as the starting point for creating a robust research agenda to address technology challenges for the adoption of Digital Financial Services in Pakistan and beyond. This workshop will be a model for other such international DFS workshops in the future.

Read the full workshop report here.

-

02 October 2017

The University of Washington’s Digital Financial Services Research Group (DFSRG) will host a Digital Financial Services (DFS) Workshop on October 4th. This event will take place in the Gate’s Commons in the Paul G. Allen Center for Computer Science and Engineering (CSE 691) between 1-4:45 pm, with a reception to follow from 5-6 pm.

The goal of this workshop is to bring members of the DFS academic community together with industry partners to develop an agenda for successful collaboration on research and the dissemination of new technologies. We will also share some of our research team member’s recent research results.

The University of Washington’s DFSRG focuses on developing technologies for people from resource constrained regions around the world to facilitate financial inclusion and alleviate poverty. More broadly, we collaborate with social scientists and industry partners, including the newly opened FinTech Center at Information Technology University in Lahore. Some of our current research highlights include an exploration of mobile money adoption and use by women in Pakistan, the implementation of digital agricultural directories to facilitate business transactions in Tanzania, and an evaluation of security within digital transactions.

The UW DFS Workshop will highlight two panels: 1) “Gender and Mobile Money” with panelists Neha Kumar (Georgia Tech), Emer Dooley (UW Foster School of Business), Skye Gilbert (PATH), Heidi Stephens Metz (Imani), and Samia Ibtasam (UW CSE). and 2) “DFS Technologies.” with panelists Ben Lyon (Caribou Digital), Lubna Razaq (ITU, Lahore), Kurtis Heimerl (UW CSE), and Sam Castle (UW CSE). We will feature talks from Himanshu Nagpal, a Senior Program Officer for Financial Services for the Poor, at the Bill and Melinda Gates Foundation; Jake Kendall, the Director of Digital Financial Services Innovation Lab, at Caribou Digital; and Joyojeet Pal, Assistant Professor, at the University of Michigan School of Information. Also, our graduate students will offer a poster session to accompany the reception. The complete agenda can be found here.

-

11 July 2017

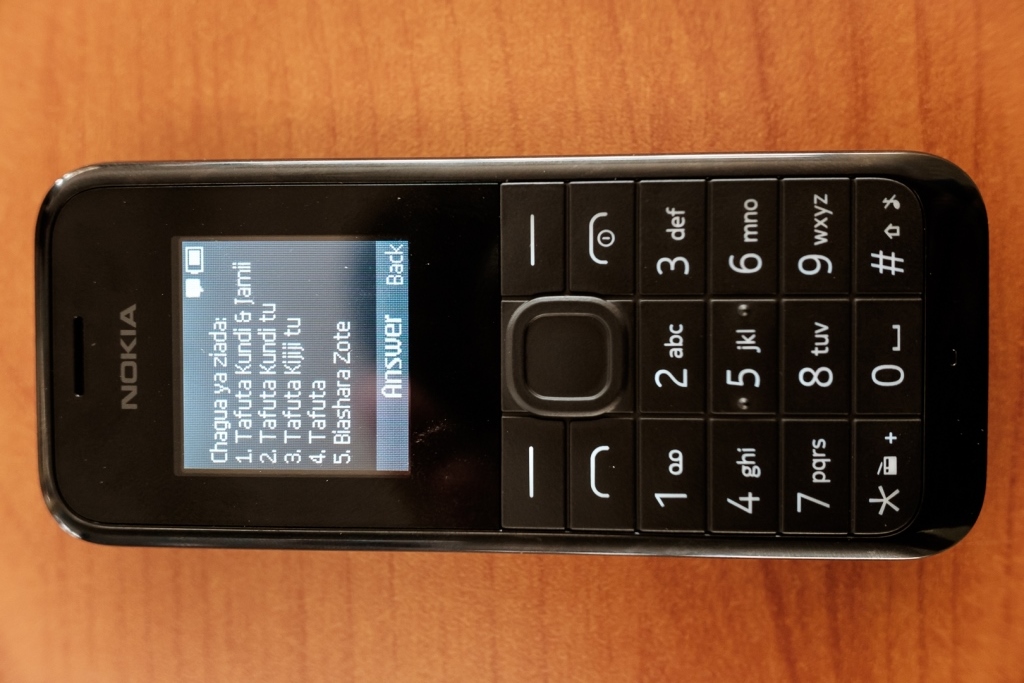

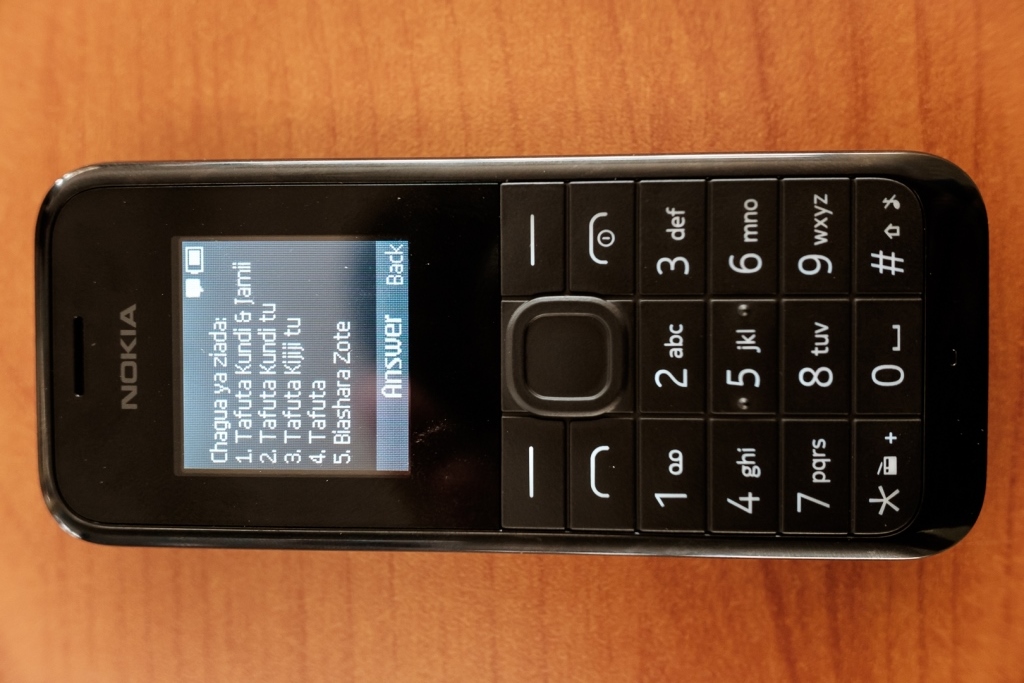

Galen Weld has traveled to Tanzania to field test the eKichabi USSD app, a mobile phone implementation of a business yellow pages for a region of rural Tanzania. The goal of the work is to demonstrate how greater access to business information can promote commerce. This is joint work with the Evans School of Public Policy. Expect an exciting summary of Galen’s travels soon!

-

01 July 2017

The DFSRG has had two papers accepted for presentation at this years ICTD Conference in Lahore, Pakistan: “An Investigation of Phone Upgrades in Remote Community Cellular Networks”, by Kushal Shah, Philip Martinez, Josh Blumenstock, Jo Dionisio and Kurtis Heimerl and “An Exploration of Smartphone based Mobile Money Applications in Pakistan”, by Samia Ibtasam, Hamid Mehmood, Lubna Razaq, Sarah Yu, and Richard Anderson, The first paper investigates the upgrade patterns for mobile phone handsets from 2G to 3G to 4G in rural Indonesia and Philippines, which is important for understanding options available to consumers for mobile money products. The second paper explores usability and learnability of mobile money applications and exposes a set of challenges associated with current products.

-

06 March 2017

We are excited to host Jacki O’Neill from Microsoft Research India. Jacki works with the Technology for Emerging Markets group and will give a talk about her ethnographic work on financial services for low income communities in India. Her talk (open to public) is on March 8 at 3:30pm in CSE 691.

-

30 January 2017

The DFSRG has launched a collaboration with Information Technology University (ITU) Lahore to start a FinTech research center. The new center will operate along similar lines to the UW center, conducting research into the challenges relating to digital financial services. Collaborative research will be conducted in areas of cybersecurity, authentication, fraud prevention, financial education, financial management, data analytics, and customer experience studies in digital financial services. The FinTech center will also promote the digitization of Government-to-Person (G2P) and Person-to-Government (P2G) payments in Pakistan. A memorandum of understanding was signed by Dr. Umar Saif, Vice Chancellor of Information Technology University (ITU) along with Dr. Richard Anderson, Head of DFSRG and Professor, Department of Computer Science and Engineering, University of Washington.

-

01 December 2016

Fahad Pervaiz and Samia Ibtasam presented papers at the 2016 ACM Dev conference in Nairobi, Kenya. Fahad presented work on evaluating security challenges for mobile money in the developing world, and Samia presented work, done at ITU prior to her arrival at UW on Immunization Information Systems. Trevor Perrier presented a poster on the UW-Pesa DemoLab project. During the visit to Nairobi, team members met with representives of MicroSave, IBM Research Africa, and Orange.

-

10 November 2016

Prof. Umar Saif, the Chairman of the Punjab Information Technology Board and the Vice Chancellor of ITU Pakistan, will be giving a Distinguished Lecture, Designing Technology for the Other 5 Billion, in the UW Computer Science and Engineering department on Tuesday, November 15, 2016 at 3:30 PM in EEB-105. This talk is open to the public. For more information see the UW Distinguished Lecture announcement.

-

01 September 2016

A paper, Let’s talk money: Evaluating the security challenges of mobile money in the developing world has been accepted for publication at the 2016 ACM Dev conference. The paper was authored by Sam Castle, Fahad Pervaiz, Galen Weld, Franziska Roesner and Richard Anderson. The paper assesses security vulenerabilities for Android mobile money applications and reports on interviews of software developers to give insights into current practices.

-

12 January 2016

UW CSE will form a Digital Financial Services Research Group with support from the Gates Foundation. This effort will be led by Richard Anderson in Computer Science and Engineering, and Josh Blumenstock in the Information School.